risk avoidance

What is risk avoidance?

Risk avoidance is the elimination of hazards, activities and exposures that can negatively affect an organization and its assets.

Whereas risk management aims to control the damages and financial consequences of threatening events, risk avoidance seeks to avoid compromising events entirely.

While the complete elimination of all risk is rarely possible, a risk avoidance strategy is designed to deflect as many threats as possible in order to avoid the costly and disruptive consequences of a damaging event.

Risk avoidance is a specific type of approach to managing risk, requiring a methodical process. Leaders must identify and assess the risks their organization faces and determine how they will eliminate the chances of those risks causing damage to the organization.

Because risk avoidance is a deliberate tactic, it is not the same as failing to identify a risk or ignoring it altogether.

How does risk avoidance fit into a risk management strategy?

Risk management is an organizational practice that begins with the following three steps:

- Identify threats to the organization as a whole, as well as its assets, capital, earnings and revenue.

- Assess the probability of those risks negatively impacting the organization.

- Quantify the damages that could be done by potential risks -- i.e., calculate their risk exposure.

Organizations face many different risks; some risks have the potential to cause significant, widespread harm to an organization, while others could cause only limited damage.

This article is part of

What is risk management and why is it important?

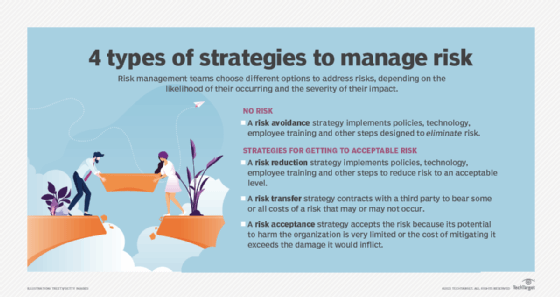

There are four main risk management strategies, or risk treatment options, that organizational leaders can take to deal with the variety of identified risks:

- risk acceptance, in which executives decide to accept a risk without taking any actions to mitigate them;

- risk avoidance, in which the organization seeks to eliminate the potential risk and the potential for damages and financial consequences of a threatening event;

- risk reduction, in which the organization puts in policies and procedures aimed at limiting a risk from harming the enterprise and/or limiting the harm done by the risk; and

- risk transfer, in which the organization contracts with a third party that assumes the risk and its consequences on behalf of the enterprise.

Each of these four approaches has benefits and drawbacks, as well as challenges and costs, associated with designing, implementing and operationalizing them.

Executives typically weigh the likelihood and negative impact of an identified risk against the respective benefits, drawbacks and costs of the four risk management options listed above.

Consequently, executives choose different options to address different risks, and their risk management plan may, in fact, include the use of all four options.

How does risk avoidance differ from risk reduction and other risk management techniques?

Risk avoidance is the only risk management strategy that seeks to completely eliminate the chance of a particular risk from happening and/or its ability to impact the organization to any degree.

Organizational leaders typically decide on risk avoidance when the risk itself has the potential to inflict catastrophic damage to the organization and/or the costs of mitigating the risk are higher than the benefits of doing so.

To avoid a risk, enterprise executives must design and implement policies, procedures, technology and employee training that support that objective.

Contrast that with the approach executives take when they decide to accept a risk. Executives typically opt for risk acceptance when the risk's potential to harm the organization is extremely limited and/or the cost of mitigating the risk exceeds the financial impact it can cause. With risk acceptance, executives take no specific action other than follow existing practices to address the risk.

Executives take a more moderate approach when pursuing either a risk reduction or a risk transfer strategy.

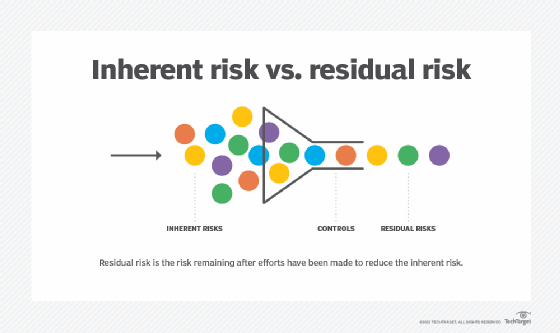

In a risk reduction strategy, executives implement policies, procedures, technology and training aimed at reducing the likelihood and/or impact of a risk. What remains after the reduction controls are in place, or residual risk, is at an acceptable level.

A risk transfer strategy follows similar steps; however, under a risk transfer strategy, a third party is paid to bear some or all of the costs and consequences if the risk causes harm or damage -- and if it doesn't.

What are examples of risk avoidance?

Examples of risk avoidance can be found across industries:

- A building company that decides to halt all construction work during an electrical storm to avoid any risk of someone getting hurt is a clear case of risk avoidance.

- A utility company that decides to have certain critical systems run on an air-gapped network -- that is, a network completely isolated from all other private and public networks -- to eliminate the risk of a cyber attack is similarly following a risk avoidance strategy.

- A retailer that decides not to collect and store personal customer data for analysis because it cannot meet data privacy regulations is also following a risk avoidance strategy.

The principle of risk avoidance also applies to individual risk.

Investors, for instance, could avoid all risk of losing any of their capital value by placing all assets in a federally guaranteed savings account instead of buying stocks, whose values would likely fluctuate.

What are the pros and cons of risk avoidance?

Like all risk mitigation strategies, the decision to avoid risk has benefits and drawbacks.

The pros and cons of a risk avoidance strategy include the following:

- Pros

- completely or nearly eliminates a risk that has the potential to damage the organization; and

- instills confidence that the organization will continue to operate because, with the risk eliminated, it won't have to plan for or contend with the negative consequences associated with the risk.

- Cons

- slows operations as employees, business partners and sometimes even customers adhere to the rules implemented to eliminate the risks; and

- limits opportunities such as increasing sales, cultivating new customers and developing new revenue streams.

For instance, the investors who opt for a savings account do indeed avoid all risk of losing their capital value but will also miss out on growing those assets more significantly by avoiding the risk associated with the stock market.

Or take the retailer that decides against keeping consumer data: It eliminated the risk of running afoul of data regulations, but at the same time, it likely drastically limited its ability to create a personalized shopping experience that could help boost sales.