conduct risk

What is conduct risk?

Conduct risk is the potential for a company's actions or behavior to harm its customers, stakeholders or broader market integrity.

It encompasses the ethical, moral and legal standards that govern business conduct. It covers a wide range of behaviors and practices that could lead to negative outcomes. Understanding conduct risk is essential for businesses as it helps them maintain customer trust, avoid legal and financial consequences, and safeguard their reputation.

Conduct risk management began gaining more attention in the corporate sector, especially the financial field, after it was revealed that unethical behavior was a primary cause of the 2007 financial crisis.

According to the Financial Stability Board, an international financial regulatory body, a major takeaway from the Great Recession of 2007 is that risk to a firm's reputation should not be underestimated and more attention must be paid to improving the quality of products sold to consumers.

In today's complex and highly regulated business environment, it is crucial for companies to understand and manage conduct risk.

Key elements of conduct risk

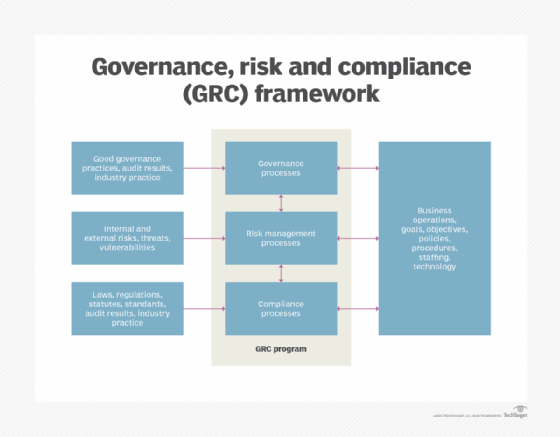

To effectively manage conduct risk, companies need to consider relevant regulations, identify conduct risk areas and determine mitigation strategies.

Understanding of relevant regulations

Conduct risk is closely tied to regulatory frameworks that govern business behavior. It is crucial for companies to understand and comply with these regulations to mitigate potential conduct risk. Knowledge of the relevant regulations allows businesses to align their practices with regulatory expectations and industry standards.

Here are some examples of legislative safeguards commonly implemented:

- Securities and Exchange Commission (SEC) regulations. In the United States, the SEC plays a crucial role in enforcing conduct risk management in organizations, particularly in the financial industry. The SEC has regulations in place to promote fair and ethical practices, prevent fraud and protect investors.

- Sarbanes-Oxley Act (SOX). Enacted in the United States, SOX is primarily focused on financial reporting and corporate governance. It sets requirements for organizations to establish internal controls, maintain accurate financial records, and ensure transparency and accountability. Compliance with SOX mitigates conduct risk and increases investor confidence.

- Consumer protection regulations. Consumer protection regulations have been implemented in many jurisdictions to safeguard consumers and prevent unfair practices. These regulations might include requirements for clear and transparent communication, fair pricing, product safety and privacy protection. Compliance with consumer protection regulations is essential for managing conduct risk when dealing with customers.

- Anti-money laundering (AML) regulations. AML regulations are designed to prevent money laundering, terrorist financing and other illicit activities. These regulations oblige organizations, particularly those in the financial sector, to implement robust risk mitigation measures, such as customer due diligence, transaction monitoring and suspicious activity reporting. Compliance with AML regulations reduces conduct risk associated with illicit financial activities.

- Dodd-Frank Wall Street Reform and Consumer Protection Act. Dodd-Frank established new government agencies to oversee the financial system and monitor the financial stability of major financial firms. It also introduced regulations for consumer protection, derivatives, credit ratings and whistleblowing, among other areas. It covers a wide range of activities such as banking, consumer finance, derivatives and corporate governance.

Identification of conduct risk areas

Conduct risk can exist across various areas of a business operation. By identifying these areas early on, companies can recognize potential risks and take proactive measures to address them.

Common areas where conduct risk might arise include customer interactions, sales practices, product design, market manipulation and fraud prevention. In the United States, a number of regulatory compliance bodies include corporate culture as a factor when considering conduct risk violations.

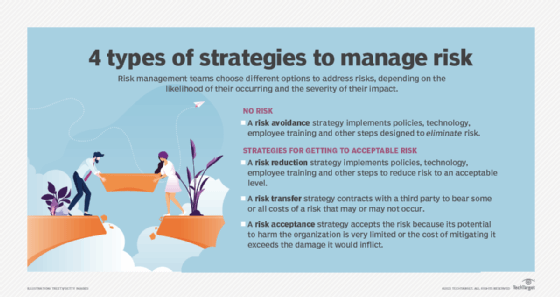

Strategies to mitigate conduct risk

Implementing robust mitigation strategies is essential to minimize conduct risk. Companies should establish frameworks and controls to prevent misconduct, provide staff training on ethical practices, develop codes of conduct, and establish reporting mechanisms to address potential instances of misconduct promptly.

Proactively managing conduct risk can prevent legal, reputational and financial consequences.

Effects and consequences of conduct risk

Conduct risk is often a problem during product development. It requires employees to actively manage potential risk issues throughout the product development lifecycle.

Conduct risk management should not stop at product development, however. It can permeate nearly every aspect business operations that involves customer interactions and does not fall under other risk categories such as credit, liquidity, market or operational risks.

The consequences of conduct risk can be far reaching. Violating conduct risk regulations can result in legal action, fines and penalties.

Companies might face regulatory enforcement actions, lawsuits from affected stakeholders and damage to their operating licenses. Notable examples include financial institutions that have faced significant penalties for improper sales practices and fraudulent activities.

Conduct risk incidents can also severely damage a company's reputation, erode customer trust and reduce customer loyalty. Negative publicity and public perception can have long-lasting effects on the company's brand image and market standing. Well-known brands that have suffered reputational damage due to conduct risk include Enron and Volkswagen.

Conduct risk incidents can result in substantial financial losses for companies. Legal settlements, regulatory fines, customer compensation and damage to long-term business prospects all contribute to these losses.

Role of proactive measures in managing conduct risk

To effectively manage conduct risk, companies should adopt proactive measures. Implementing comprehensive mitigation measures is essential for preventing conduct risk incidents.

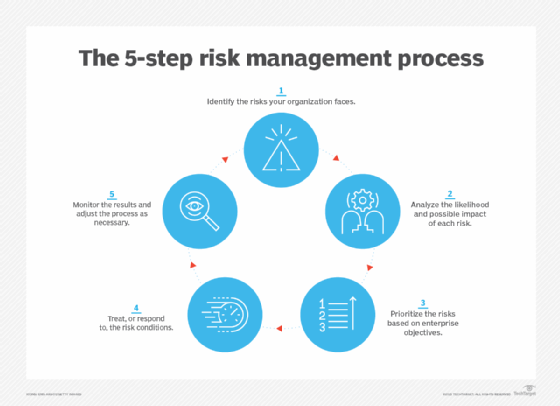

The process for managing conduct risk will be different at each company based on factors such as the company's industry and its customer base. In general, a successful step-by-step conduct risk management approach includes the following:

- Identify and assess conduct risk vulnerabilities throughout the organization's departments.

- Develop and monitor key conduct risk metrics unique to the organization's needs.

- Educate and train staff about their conduct risk avoidance responsibilities, and reinforce training regularly.

- Evaluating employees' sales incentives programs and make sure employees are compliant with consumer protection rules when interacting with customers.

- Establish clear policies and procedures, promote a strong risk culture across the organization, and emphasize ethical conduct and compliance.

- Foster a speak-up culture that encourages employees to report potential misconduct without fear of retaliation.

A robust risk culture ensures that employees understand the importance of conduct risk management and actively contribute to its mitigation efforts.

Additionally, a third-party compliance audit can help an organization to evaluate and improve the following:

- How employees interact with customers.

- The firm's product approval process.

- How the company addresses regulatory requirements.

- How decisions are made.

- A whistleblower policy (if it has one) that lets employees report dishonest or illegal business activities without repercussions.

Conduct risk is a critical consideration for businesses across industries. By understanding the key elements of conduct risk, recognizing potential risk areas and implementing proactive measures, companies can effectively manage and mitigate conduct risk.

Failure to address conduct risk can lead to legal, reputational and financial consequences that can harm the long-term success and sustainability of a business. By prioritizing conduct risk management, companies can protect their customers, maintain trust, and foster a culture of integrity and accountability.

Explore top enterprise risk management trends and what it means to implement an enterprise risk management framework. Check out common risk management failures and how to avoid them. Read about the similarities and differences between risk appetite vs. risk tolerance.